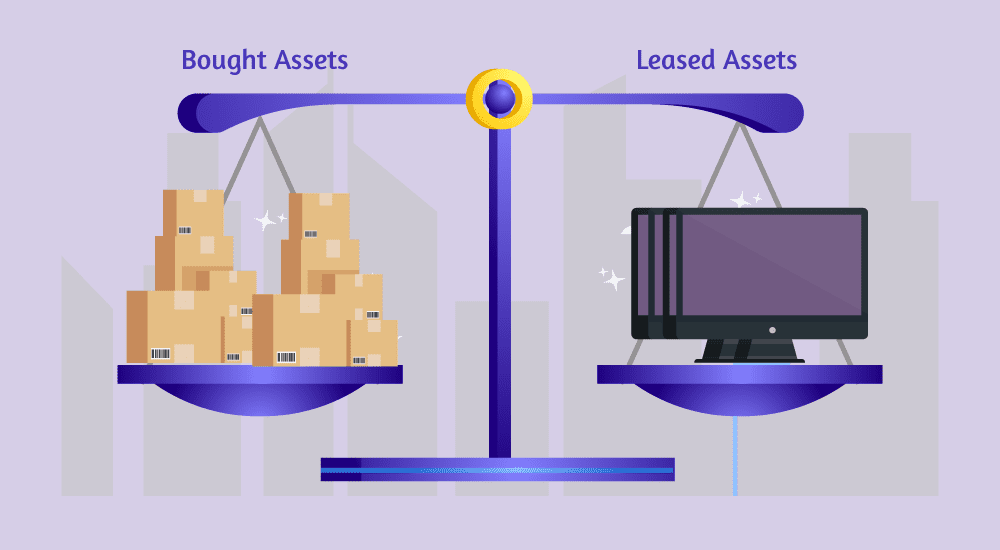

“The Advantages of Leasing: Flexible, Cost-Effective Asset Acquisition”

Leasing is an option many individuals and businesses consider when acquiring assets. It offers a range of benefits that can make it an attractive choice in certain situations. From flexibility to cost-effectiveness, leasing can provide advantages that purchasing does not. Here are some key benefits of leasing to consider.

Flexibility

One of the primary benefits of leasing is the flexibility it offers. Whether it’s a car, equipment, or property, leasing provides the opportunity to use an asset without having to commit to owning it. This can be particularly advantageous for businesses that need to regularly update their equipment or technology to stay competitive. Leasing allows for easy upgrades and the ability to adapt to changing needs without the long-term commitment of ownership.

Cost Savings

The benefits of leasing can also result in cost savings, especially in the short term. Rather than making a large upfront payment to purchase an asset, leasing typically involves lower initial costs. This can be beneficial for individuals and businesses that prefer to conserve their capital or allocate it to other areas of their operations. Additionally, leasing may include lower monthly payments compared to loan repayments, making it a more manageable option for budgeting.

Maintenance and Repairs

Another advantage of leasing is that maintenance and repairs are often included in the lease agreement. This means that lessees can avoid the additional costs and responsibilities associated with upkeep. For businesses, this can help in budget forecasting by eliminating unexpected maintenance expenses. Additionally, it can provide peace of mind knowing that the lessor is responsible for ensuring the asset is in good working condition.

Access to Higher-End Assets

Leasing can also provide access to higher-end or more advanced assets that may be financially out of reach for outright purchase. This is particularly relevant in industries that require cutting-edge technology or specialized equipment. By leasing, businesses can utilize state-of-the-art assets without the significant investment required for ownership. This can enhance operational efficiency and competitiveness.

Tax Benefits

In some cases, leasing can offer tax benefits for businesses. Lease payments are often considered a deductible business expense, which can reduce the lessee’s taxable income. It’s important to consult with a tax professional to understand the specific tax implications of leasing based on individual or business circumstances.

Conclusion

Leasing presents a range of benefits that can make it a viable option for many individuals and businesses. From flexibility and cost savings to access to higher-end assets, the advantages of leasing can align with various needs and objectives. When considering whether to lease or purchase, it’s essential to evaluate the specific requirements and long-term goals to determine the most suitable approach for acquiring assets.

Leasing provides a flexible and cost-effective way to access assets without the commitment of ownership. With benefits such as included maintenance, access to higher-end assets, and potential tax advantages, leasing can be a strategic choice for many. Whether for personal or business use, understanding the advantages of leasing can inform decision-making and contribute to efficient asset management.