Intraday Trading Strategies

Intraday trading, often referred to as day trading, is a financial strategy where traders buy and sell financial instruments within the same trading day. In India, with its vibrant stock market, intraday trading has gained immense popularity among investors seeking quick returns. However, success in intraday trading requires a deep understanding of market dynamics, technical analysis, and effective strategies. In this article, we will explore key intraday trading strategies in India that can help traders navigate the complexities of the stock market.

Selecting the Right Stocks

Before diving into intraday trading, it’s crucial to choose the right stocks. Opt for highly liquid stocks with significant trading volumes. Liquidity ensures that you can enter and exit positions swiftly without significant price impact. Stocks from sectors with higher volatility, such as technology or pharmaceuticals, can provide more intraday trading opportunities. On platforms like HDFC SKY can find a variety of stocks to invest in. You can choose the suitable ones as per your needs.

Technical Analysis

Intraday trading heavily relies on technical analysis. Traders use charts, patterns, and technical indicators to make informed decisions. Common technical indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Understanding price patterns and support/resistance levels can help identify entry and exit points, giving traders a competitive edge.

Risk Management

Intraday trading involves quick decision-making, and losses can accumulate rapidly. Effective risk management is essential to protect your capital. Set stop-loss orders to limit potential losses, and avoid risking more than a small percentage of your trading capital on a single trade. Diversify your trades to spread risk and never let emotions dictate your trading decisions.

Pre-market Analysis

Successful intraday traders start their day with thorough pre-market analysis. Monitor global market trends, economic indicators, and company news that may impact your selected stocks. Pre-market analysis provides valuable insights into potential market directions, helping traders make more informed decisions during the trading day.

Use of Leverage

Intraday trading allows traders to use leverage, magnifying both potential profits and losses. While leverage can enhance returns, it also increases risk. It’s crucial to use leverage judiciously and be aware of the risks involved. Many successful intraday traders prefer to trade without excessive leverage to maintain better control over their positions.

Scalping Strategy

Scalping is a popular intraday trading strategy where traders aim to make small profits from minor price movements. Scalpers typically make numerous trades in a day, holding positions for a very short duration. This strategy requires quick decision-making, discipline, and the ability to capitalize on small price differentials.

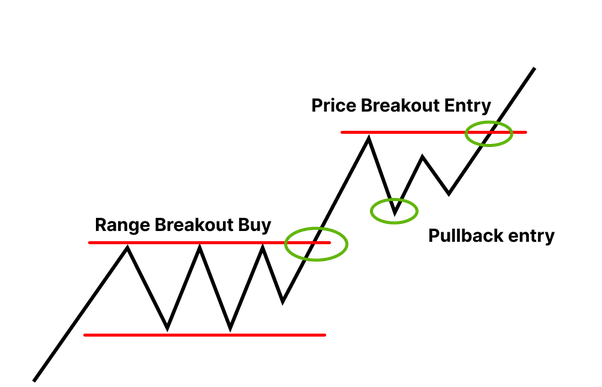

Breakout Trading

Breakout trading involves identifying key support and resistance levels. When a stock’s price breaks above resistance or below support, it signals a potential trend reversal or continuation. Traders can enter positions based on these breakouts, aiming to profit from the subsequent price movement.

Trend Following

Following the prevailing market trend is a common intraday strategy. This involves identifying the dominant trend using technical analysis and aligning trades in the direction of that trend. Trend-following strategies work well in markets with clear and sustained directional movements.

News-Based Trading

Intraday traders often capitalise on news and events that can cause significant price movements. Keep an eye on company announcements, economic reports, and global events that may impact the market. Quick reactions to news can lead to profitable trades, but it’s essential to stay informed and act swiftly. You can get the latest news and events on a good Demat account app. It is essential that you choose a good platform that offers such useful services.

Intraday Trading Timeframe

Traders engage in rapid decision-making, analyzing short-term price movements and leveraging various technical indicators on shorter time intervals, such as 1-minute, 5-minute, or 15-minute charts. The focus on short time frames allows intraday traders to capitalize on small price fluctuations and market inefficiencies that occur within the span of a single trading session.

The choice of the intraday time frame depends on the trader’s preferences, risk tolerance, and the specific strategy employed. Some traders may prefer the intensity of the 1-minute chart for scalping, while others might opt for slightly longer time frames, such as 15-minute charts, to capture more substantial price movements. Regardless of the chosen time frame, intraday traders must remain vigilant, as market conditions can change rapidly, requiring swift and decisive actions to seize

Conclusion

Intraday trading in India offers exciting opportunities for those equipped with the right knowledge and strategies. It’s important to continuously educate yourself, stay updated on market trends, and practice disciplined trading. Remember that intraday trading involves inherent risks, and there are no guarantees of success. By combining technical analysis, risk management, and a well-defined strategy, traders can increase their chances of navigating the complexities of the intraday trading landscape successfully.