How Couples Can Adopt The Same Financial Goals And Win

In 2024, I am transitioning from a spender to a saver mindset. I am returning to frugal habits reminiscent of my lifestyle in the first thirteen years after college. This change is prompted by the need to rebuild liquidity.

One area I’m targeting to cut expenses is food. After a three-month experiment involving increased spending on meals, I grew tired of the excess. Now, I’m swinging the other way—planning to eat less for weight loss, opting for leftovers, and cooking more to save money.

The first day of the new year marked a positive start toward achieving my 2024 goals. I rose early to edit and publish a post, followed by a 1.5-hour pickleball session—a commitment tied to my New Year’s resolutions.

However, upon returning home at 11:35 am, my optimism took a hit when I discovered an Uber Eats delivery driver blocking my driveway. Perplexed, I inquired about the address he was searching for, only to realize it was mine.

To my chagrin, my wife had ordered $48 worth of udon noodles for the kids, while I had mentally prepared to make cost-free grilled cheese sandwiches. Yum! Unbeknownst to me, they had already eaten grilled cheese for breakfast.

Can Be Hard To Get On The Same Financial Page As a Couple

Typically, I’m okay with spending money on food delivery to save time. My wife was being productive, editing the final chapters of my new book. However, with my resolution to save money in the new year, I felt disappointed on the very first day.

Here’s the thing: at 12:35 pm, we were heading to a friend’s New Year’s party, which I attended with our son last year. They host a great party with a ton of food and beverages! So, stuffing ourselves beforehand and spending $48 on lunch felt like a double kick in the nuts.

We only argued for a minute and then moved on. But it got me thinking about how difficult it can be for couples to get on the same financial page, especially when there is a desired shift in spending habits.

At the end of the day, I failed to do the following:

- Clearly communicate that I want to spend less money on food this year.

- Inform my wife there is plenty of food for both adults and children to eat at the New Year’s lunch party.

- Prepare food for my kids before leaving to play pickleball for an hour.

How To Adopt The Same Financial Goals With Your Partner

The cause of many arguments between couples often stems from unspoken expectations. I had published my 2024 goals post and anticipated we would save money on lunch by attending a friend’s lunch party. The problem is, I didn’t share my expectations with my wife.

To me, I just assumed this was a logical conclusion. To her, she did not know what to expect from the party and was busy working. She was also ordering extra to take care of dinner for all of us and continuing a Japanese tradition of eating noodles on New Year’s Day for long life.

In her mind, logically, it was better to feed our children before the lunch party to avoid hangry meltdowns and keep them happy. For reference, our kids usually eat lunch at 11:30 am, so having them wait to eat until 1 pm would be a recipe for potential meltdowns.

Getting on the same financial page with your partner is crucial for a harmonious relationship and can significantly minimize arguments. Here are 10 strategies to achieve financial alignment.

1) Open Communication

- Foster open and honest communication about money matters. Establish a safe space for discussions, ensuring both partners feel heard and understood.

- Regularly check in on your financial goals and discuss any changes in income, expenses, or priorities.

2) Set Shared Goals

- Define short-term and long-term financial goals together. This could include saving for a home, planning for children’s education, or preparing for retirement.

- Ensure that your goals align with both partners’ values and aspirations.

3) Budget Together

- Create a joint budget that reflects your shared financial priorities. Be transparent about your individual spending habits and work together to find a balance.

- Regularly review and adjust the budget as circumstances change.

4) Understand Each Other’s Money Mindset

- Recognize that individuals often have different attitudes and beliefs about money. Understand your partner’s money mindset, considering factors like upbringing and past experiences. There’s a big difference between having a scarcity mindset and an abundance mindset.

- Be patient and empathetic, working towards finding common ground.

5) Designate Financial Roles

- Clearly define each partner’s responsibilities regarding finances. This could involve one person handling bill payments, while the other manages investments, for example.

- Regularly discuss and assess whether these roles need adjustments.

6) Emergency Fund and Insurance

- Prioritize building an emergency fund worth at least six months of living expenses to create a buffer for unexpected expenses.

- Secure appropriate insurance coverage as well. The amount of mental relief my wife and I experienced after getting two matching 20-year term life insurance policies with PoilcyGenius recently was huge. The mental relief alone is worth the cost of the premiums.

7) Financial Dates

- Schedule regular “financial dates” to discuss money matters. Make it an enjoyable activity by combining it with a meal or a walk, creating a positive association with financial discussions.

8) Compromise

- Recognize that compromise is key. You may not always agree on every financial decision, but finding middle ground ensures that both partners are comfortable with the choices being made.

9) Financial Education

- Invest time in financial education together. Attend workshops, read books like Buy This Not That, listen to podcasts that talk about couple’s issues, or take courses that enhance your understanding of personal finance.

- Learning together will strengthen your financial literacy and provide a shared foundation for decision-making.

10) Seek Professional Guidance

- If needed, consult a financial advisor or marriage counselor. A neutral third party can provide guidance, especially during major financial decisions or if there are persistent disagreements.

Going From Spender To Saver Can Be Hard

After years of relatively free spending, transitioning from a spender’s mindset to a frugal one can be challenging. As the manager of our family’s finances, I feel the pressure to ensure our financial security, and the more we have, the safer I feel.

I’m willing to make extreme sacrifices like consuming only ramen noodles and water daily if it means replenishing our bank account. I’m also willing to work 60-80 hours a week for as long as necessary to achieve financial freedom sooner. I know this because it’s the approach I took to retire at 34 in 2012!

However, I recognize that my perspective might be considered extreme. My fear of poverty stems from growing up in developing countries surrounded by it. Consequently, embracing frugality makes me feel more secure.

Fasting all morning to enjoy free food at a friend’s lunch party brings me joy. Wearing the same clothes since 2002 feels like a badge of honor. I even wear my socks until they have not one, but two holes in them!

Some might say I have a frugality disease. Despite efforts to be less frugal since leaving my day job in 2012, the reality is that losing a stable income source doesn’t make spending money any easier. And neither does having children.

If I’m not careful, my frugality may lead to lifestyle deflation and unnecessary conflicts with my wife. At the same time, if we spend excessively, financial stress will grow. For the well-being of our family, we must come to a compromise.

Best Strategy To Become More Frugal

If you feel like you’ve been spending too much and want to adopt a more frugal lifestyle, one effective approach is to consider the suffering of others.

Certainly, creating a budget, cutting up your credit cards, and avoiding unnecessary purchases are valuable steps. However, the most impactful way to shift from being a spender to a saver is to acknowledge the extent of poverty in the world.

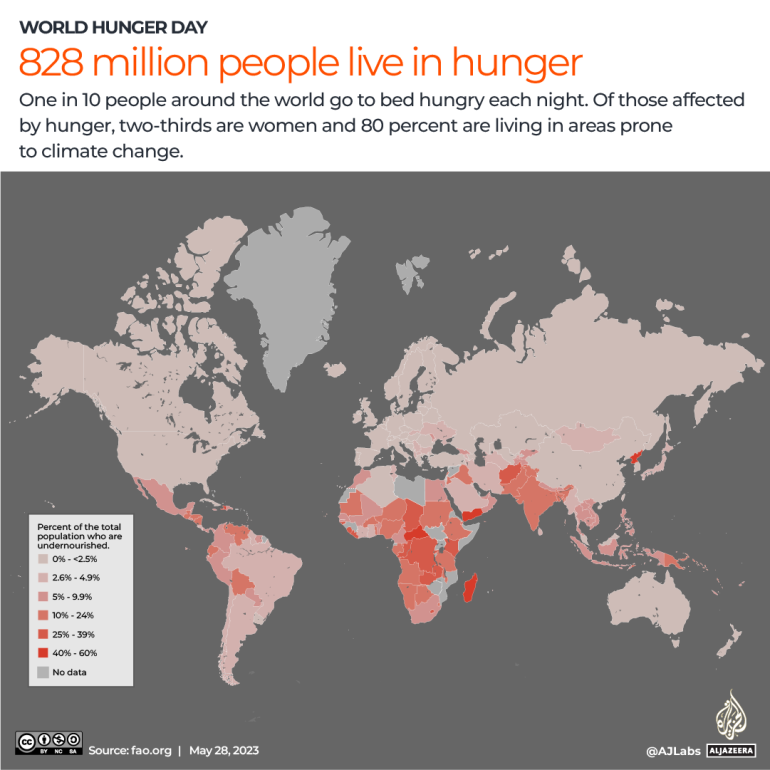

Approximately 828 million people, or 10% of the global population, go to bed hungry every night. When you become aware of this and witness the faces of those who are starving, you are more likely to avoid overeating and gaining unnecessary weight. How can you indulge in another slice of key lime pie when there’s a child out there who has only had one bowl of rice and pickles to eat all day?

Around 650 million people live in poverty. Experiencing or witnessing poverty is likely to make you less extravagant and more mindful of your spending habits. Consider watching videos online or taking a trip to a less affluent country. I assure you that such experiences will make you more conscientious about your spending.

The Need To Communicate Better

My wife is not a big spender by any means. She purchased her wedding dress at Target for $80 in 2008, and to this day, her favorite store remains Target, where we go maybe once a quarter. She doesn’t own fancy shoes or designer clothes. Most recently, she was perfectly content with us continuing to live in our old house until I convinced her otherwise due to my real estate FOMO.

Improving our communication about financial expectations is essential. I can’t assume she knows what I want, and likewise, she can’t assume what I want. Continuous assumptions will only lead to ongoing arguments.

Therefore, I’m adding another goal for 2024: to communicate better. Despite writing and podcasting for many years, I realize I’m not the communicator I aspire to be. I need to be more explicit when explaining things to my wife to minimize miscommunication.

At the end of the day, spending $48 on lunch before a lunch party isn’t going to break us. Ordering turned out to be a good move because the food at the party was too spicy for the kids. Here’s to better dialogue!

Questions And Suggestions

Readers, have you found it difficult to get on the same financial page with your significant other? How do you find solutions to adopt similar financial goals? Have you ever gone from being a free spender to suddenly an ultra-frugal person? If so, how long did you keep it up and what were you strategies?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I plan to speak to my wife about many financial topics going forward.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.